And you can also compute the variable expense ratio, which is the percentage of variable expenses divided by sales. To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail. Gross margin is calculated before you deduct operating expenses shown in the income statement to reach operating income.

How to calculate contribution margin

Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience. Barbara has an MBA from The University of Texas and an active CPA license. When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. These can fluctuate from time to time, such as the cost of electricity or certain supplies that depend on supply chain status. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Let’s get more productive

If you were to manufacture 100 new cups, your total variable cost would be $200. However, you have to remember that you need the $20,000 machine to make all those cups as well. A contribution margin represents the money made by selling a product or unit after subtracting the variable costs to run your business. To run a company successfully, you need to know everything about your business, including its financials.

Fixed Cost vs. Variable Cost

- You can show the contribution margin ratio as CM relative to sales revenue.

- The sales price is $80, variable costs per unit is $50 and fixed costs are $2,400,000 per annum (25% of the which are manufacturing overhead costs) .

- These costs would be included when calculating the contribution margin.

- The business can also use its contribution margin analysis to set sales commissions.

- Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently.

Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold 100 shirts, assuming an individual variable cost per shirt of $10, the total variable costs would be $1,000 (100 × $10). If they sold 250 shirts, again assuming an individual variable cost per shirt of $10, then the total variable costs would $2,500 (250 × $10). A contribution 12 ways to increase sales for your small business margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. The contribution margin further tells you how to separate total fixed cost and profit elements or components from product sales. On top of that, contribution margins help you determine the selling price range for a product or the possible prices at which you can sell that product wisely.

The Evolution of Cost-Volume-Profit Relationships

Calculate the company’s contribution margin for the period and calculate its breakeven point in both units and dollars. Put more simply, a contribution margin tells you how much money every extra sale contributes to your total profits after hitting a specific profitability point. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights. Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold.

Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit's cost as the number of units sold increases. The contribution margin is affected by the variable costs of producing a product and the product's selling price. The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs. Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc).

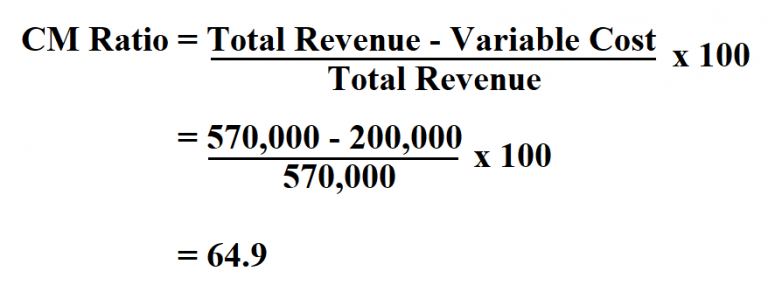

To get the ratio, all you need to do is divide the contribution margin by the total revenue. The contribution margin may also be expressed as fixed costs plus the amount of profit. For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits.

For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify the increase in fixed costs. This assessment ensures investments contribute positively to the company’s financial health. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit. To convert the contribution margin into the contribution margin ratio, we’ll divide the contribution margin by the sales revenue. The difference between fixed and variable costs has to do with their correlation to the production levels of a company. As we said earlier, variable costs have a direct relationship with production levels.

Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit. Contribution margin ratio equals contribution margin per unit as a percentage of price or total contribution margin TCM expressed as a percentage of sales S. Crucial to understanding contribution margin are fixed costs and variable costs.

This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs. Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels.

This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase. These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.