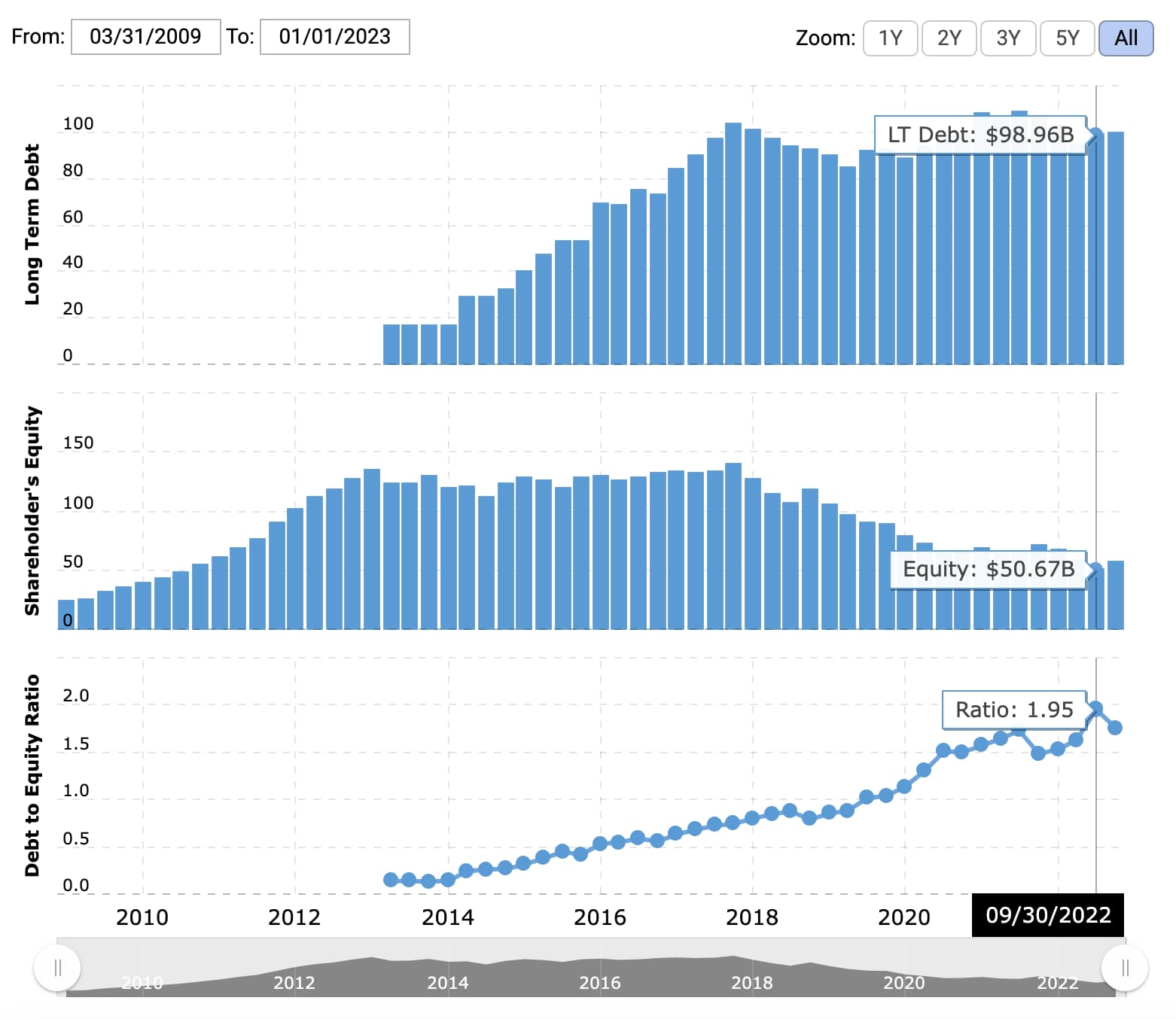

However, a good debt-to-equity ratio can be as high as 2.0 or occasionally higher depending on the industry, cash flow, and company size. Larger companies can sometimes carry higher debt levels without too much risk. By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario.

How Can the Debt-to-Equity Ratio Be Used to Measure a Company’s Risk?

Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits. A company with a D/E ratio that exceeds its industry average might be unappealing to lenders or investors turned off by the risk. As well, companies with finance D/E ratios lower than their industry average might be seen as favorable to lenders and investors. Such a high debt to equity ratio shows that the majority of this company’s assets and business operations are financed using borrowed money. In case of a negative shift in business, this company would face a high risk of bankruptcy.

Calculating and interpreting the debt-to-equity ratio

Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. The nature of the baking business is to take customer deposits, which are liabilities, on the company's balance sheet. And, when analyzing a company's debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses. It's useful to compare ratios between companies in the same industry, and you should also have a sense of the median or average D/E ratio for the company's industry as a whole. Additional factors to take into consideration include a company's access to capital and why they may want to use debt versus equity for financing, such as for tax incentives.

Create a Free Account and Ask Any Financial Question

Generally speaking, a debt-to-equity or debt-to-assets ratio below 1.0 would be seen as relatively safe, whereas ratios of 2.0 or higher would be considered risky. Some industries, such as banking, are known for having much higher debt-to-equity ratios than others. In the consumer lending and mortgage business, two common debt ratios used to assess a borrower’s ability to repay a loan or mortgage are the gross debt service ratio and the total debt service ratio. Some sources consider the debt ratio to be total liabilities divided by total assets.

- A company with a high debt ratio relative to its peers would probably find it expensive to borrow and could find itself in a crunch if circumstances change.

- In the financial industry (particularly banking), a similar concept is equity to total assets (or equity to risk-weighted assets), otherwise known as capital adequacy.

- This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts.

- For companies that aren't growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued.

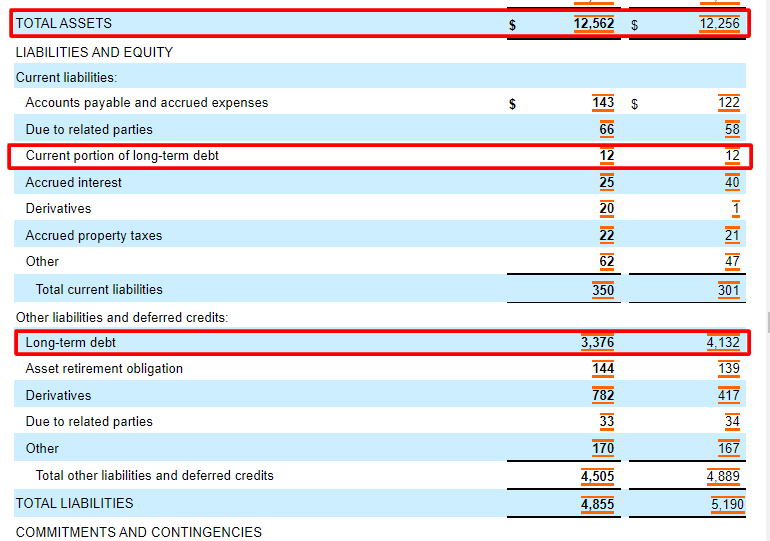

Debt Ratio Formula and Calculation

Long term liabilities are financial obligations with a maturity of more than a year. They include long-term notes payable, lines of credit, bonds, deferred tax liabilities, loans, debentures, pension obligations, and so on. Debt to equity ratio also measures the ability of a company to cover all its financial obligations to creditors using shareholder equity in case of a decline in business. A company with a negative net worth can have a negative debt-to-equity ratio. A negative D/E ratio means that the total value of the company's assets is less than the total amount of debt and other liabilities. However, start-ups with a negative D/E ratio aren't always cause for concern.

Debt to equity ratio: Calculating company risk

If a company's D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used.

Both ratios, however, encompass all of a business's assets, including tangible assets such as equipment and inventory and intangible assets such as copyrights and owned brands. Because the total debt to assets ratio includes more of a company's liabilities, this number is almost always higher than a company's long-term debt to assets ratio. A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations. This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts. The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt.

However, this will also vary depending on the stage of the company's growth and its industry sector. D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. The current ratio measures the capacity of a company to pay its short-term obligations in a year or less. Analysts and investors compare the current assets of a company to its current liabilities. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times.